Recent Comments

A Fool for Listening… on Garth Turner’s track rec…

Dave Simms on False prophets of doom: Garth…

Zeke on Truth and justice prevails. I…

Gary on Truth and justice prevails. I…

Gary on Truth and justice prevails. I… -

Recent Posts

Archives

- March 2015

- February 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- October 2012

- September 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- November 2011

Categories

- Alberta economy

- Bidding wars

- Blog is on holidays

- Buyers

- Calgary Herald

- Calgary SFH

- Canmore

- City of Calgary

- CMHC

- Correction

- Defamation

- Developers

- Fearmongers

- First-time buyers

- Flood of 2013

- Graph: Sales vs inventory

- Greater Fool

- Historical comparison

- Housing starts

- How long will it take to sell?

- Inaccuracies

- Infrastructure

- Interest rates

- Luxury sales

- Market update

- Month-end

- Mortgages

- Motivations

- Over list price

- Pendings

- Population

- Predictions

- Price correction

- Price per sq ft

- Re-lists

- Renting

- Ross Kay

- Sellers

- Statistics

- U.S. real estate

- Uncategorized

- Unusual occurrences

- Vancouver

Blogroll

Monthly Archives: August 2013

Image ImageWhy 3 years?

‘The real estate executive says July sales statistics from a historical standard were “tepid” and adds the numbers gets “the big headline” because the comparison is to a period when housing sales were slumping badly.’

http://business.financialpost.com/2013/08/15/canadas-housing-market-the-one-that-no-one-can-predict/

If you’ve followed my blog, you’ll be aware that I’ve been comparing the present year to the average of the past 3 years when I compile the market updates. The story in the Financial Post illustrates the reason why. A single year can be an outlier, an anomaly. It can severely distort the overall picture when comparing to a single year.

In the same article, David Madani of Capital Economics gets thrown under the bus for his history of incorrect predictions. He’s been predicting a 25% correction consistently for 30 months. If the Canadian market declines 25% from today’s prices, it will be pretty much back where it was when he started his forecasts. Now that Harold Camping has met his maker, perhaps Madani can take his place at the table.

It would appear that CREA is the voice of calm and reasonableness: “Canadian home sales have staged a bit of a recovery in recent months after having declined in the wake of tightened mortgage rules and lending guidelines last year,” said Gregory Klump, chief economist with CREA, who expects August results will also look strong as they are compared to a weak 2012.”

Accolades to First Foundation

When Madani first made his prediction in Feb 2011, it was rebutted by a mortgage broker who wrote, “people are not over-leveraged, that our incomes are sufficient to pay our obligations, and that the fundamentals are solid for a good, old fashioned, boring real estate market where reality overcomes emotion and conjecture.” It wasn’t sensationalist enough to attract any headlines, but it was accurate. Why David Madani is wrong

I’m not sure how a guy like Madani is able to keep his job in the light of such incorrect forecasts. On Capital Economics home page it states, “we have gained an enviable reputation for original and insightful research.” Good thing they don’t claim that it’s accurate.

Posted in Historical comparison, Predictions, Statistics

Fireworks in Canmore

More recreational buyers are driving up the demand for Canmore property. Sales in the mountain town are up 32% so far this year. There are currently only 229 properties for sale in Canmore which is very low inventory and a drastic change from the depths of the recession felt in Canmore, when there were 400-500 listings on the market at any given time.

Canmore realtor Jessica Stoner reports:

“The Canmore real estate market is strong and very active. It is not what many expected. It was assumed the market sales volume would slow down as we recovered from the flood. It was also assumed that buyers would be shy about buying after such a powerful and damaging display by mother nature, knowing she can get out of our control at times.

However, the buyer’s market has made its intentions clear. Canmore is an ever popular destination and buyers are buying.”

Prices are very similar to last year’s, but as Stoner says, “Should these higher sales volumes continue, it is likely we will start to see price appreciation across the board in Canmore in the remainder of 2013.”

Canmore average prices Jan – Aug 2013:

Single family homes $781,000

Townhouse-duplex $582,000

Condo $374,000

Hotel condo $167,000

Posted in Canmore

Market update Aug 1 – 14, 2013

18% of sales have been for list price or higher in August.

Canada’s house price index reached an all-time high in July according to Teranet, an independent reporting concern. Calgary real estate review – Teranet

“Good news like strong home sales is potentially bad”

Anyone who’s followed the forecasts of the well-educated economists, the pundits like Garth Turner, crazed attention-seeking bubble bloggers, or lowly realtors, the housing market predictions have been a comedy of errors(except for the realtors). Most would excel at being contortionists. Reversing direction so many times has produced dizziness and clouded analysis(see quote on blog header from Calgary Rip-off).

Anyone who’s followed the forecasts of the well-educated economists, the pundits like Garth Turner, crazed attention-seeking bubble bloggers, or lowly realtors, the housing market predictions have been a comedy of errors(except for the realtors). Most would excel at being contortionists. Reversing direction so many times has produced dizziness and clouded analysis(see quote on blog header from Calgary Rip-off).

Porter: Strong sales means we’re drunk

All the bases are now covered. After reading for eons from guys like Garth Turner that the precursor to a crash is lower sales combined with higher prices, we now have Bank of Montreal chief economist Douglas Porter taking the opposite view, saying strong sales are bad news. “Canadians are already drunk on housing, so imbibing more means the inevitable hangover will be all that much worse.”

Madani: Persistent, consistent, and always wrong

“It’s astonishing to me that people are not picking up on this. If you see volumes crash and prices still rising, you shouldn’t be thinking everything is fine, you should see that as a warning sign.” David Madani from Capital Economics has been predicting a 25% drop in prices every year for as long as I can remember, and true to form, he’s back with the same prediction. I won’t be too hard on him, however, since he’s a Bugs Bunny fan. “Homebuilders are having a Wile E. Coyote moment” as when the perpetually ill-starred cartoon character realizes he has overshot the cliff and looks down to see nothing but air under his feet.

Garth Turner: I didn’t say crash

Garth Turner: I didn’t say crash

If Garth were a cartoon character, it would have to be Charlie Brown. He’s been ready to kick the football many times, only to have it pulled away at the last second, time and time again. Every year, some new development is the harbinger of the long-awaited crash: Higher interest rates. 35-year amortizations. Mandatory 5% down payments. 30-year amortizations. Unemployment. 25-year amortizations. Lack of first-time buyers. Now, this year, the silver bullet is the recent capping of CMHC guarantees. For six years he’s been lining up in anticipation of a big score, but rather than kicking the ball through the goal posts, he’s tripped at the line of scrimmage.

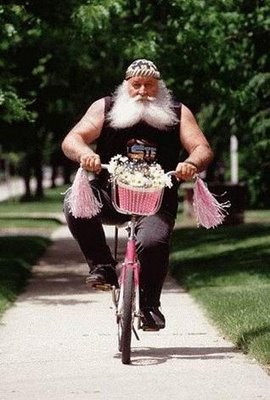

His futility has resulted in him saying that he never wanted to kick the ball in the first place. When confronted with the truth, he blames the victims for listening to him: “it was your decision.” Never one to be encumbered by facts, he has managed to keep a loyal following with his fantastic writing ability, sexual connotations, and lewd pictures. If nothing else, he knows that sex sells, understands herd mentality, and that people easily forget. In other words, he’s another Smoking Man but with good grammar and spelling, but not as intelligent. Cult followers have a difficult time thinking for themselves, but they should pay attention to these 10 warning signs. For example, #4 “Unreasonable fear about the outside world, such as impending catastrophe, evil conspiracies.” Yikes.

From the Calgary Herald: Canadians appear to be drunk on housing and approaching a hangover

Posted in Calgary Herald, Correction, Fearmongers, Greater Fool, Predictions

Market update Aug 1 – 9, 2013

With inventory down 35% from the norm, and new listings hard to come by, it’s almost unfathomable that sales are up 39%. Don’t expect too much of a lull in activity which usually happens at this time of year, unless we completely run out of homes to sell.

Sales to first-time buyers were up 39% in July compared to the 3-year average, but I expect this group will be affected most by the CMHC mortage cap, and a drop in first-time buyers is most likely to eventually occur.

Posted in Calgary SFH, First-time buyers, Market update

Garth Turner’s track record speaks for itself

The tone of the comments on Garth Turner’s GreaterFool.ca has taken a pronounced turn. Many readers(and many more whose comments were deleted by Garth) of his blog have finally realized the emperor has no clothes. His long-awaited, much-anticipated housing crash didn’t occur. Garth now denies that he ever predicted a crash, despite writing a book entitled “After the Crash.” The peasants are becoming restless with the never-ending promises of ultra-low house prices. Promises which never become Garth’s fabled houseageddon. Some recent comments which would have been anathema a few years ago…

If your financial advice was half as good as your writing, I’d be buying a nice place in calgary for 360k, not 500k.

I want prices to fall, but its not falling at this point. It’s not as bad as Garth makes it seems.

Spin it any way you like, over 8,000 sales in July for the GTA is a strong month and hardly an indicator of a collapsing housing market.

The truth is that individuals who have been waiting on the sidelines for this event to occur have unfortunately lost an opportunity this time out.

Why is it when anyone posts an opposing view here that they get attacked, called names and chant delete him, delete him? 5 years and waiting for the big collapse maybe a tad frustrating?

If anything, guys like Garth and Peter Schiff that keep calling for crashes just cause others to lose money by waiting for ever.

I’ve been waiting since 2006 for this mythical crash. Maybe in 2053?

Garth there are no signs that real estate is going down at this time in toronto…..after all these mortgage changes it still has held up…..if it is harder to buy now then why after one year has there not been serious cracks in the market…

And the wait continues and the predictions continue to be incorrect.

When will prices be at the same point of when this blog started?

The resiliency of the market has stunned many experts over the past few years – I believe the best advice is to just to get on with your life, and view “Nostradamus type predictions” as “for entertainment purposes only”.

Remember when Garth was selling survival gear and squirrel recipes? Now pretending it never happened: http://shop.xurbia.ca/

Garth’s realtorhate is running at a fever pitch. He now has a knee-jerk reaction to any commenter who disagrees with him. In adition to accusing them of being a realtor, he also calls them liars. Lashing out, making assumptions that are insulting and judgemental, could be a sign that he’s losing his grip.

Turner is a harsh critic of the media, but he forgets that at one time, he was quite happy to take money for advertising which today would be classified as “advertorials.”

- Paying for time:

- Wendy Mesley of CBC: I just wanted to ask you one question about how many financial links there can be to people on your show before it starts to get sticky. Garth Turner: I’ll only answer that by way of saying that, ah, because we’re not the CBC and we don’t get money given to us, that we have to run a business for which revenues are generated and the bulk of the revenues are generated by selling sponsorships and advertising and what we call billboards.

His yearly predictions have been notoriously incorrect, with real estate boards across the country coming through year after year with more accurate forecasts. A pattern of making incorrect predictions.

Okay, so no crash. How about a correction and slow melt? Well, maybe lowering the amortization from 40 to 25 years should do it. Requiring a 5% down payment will most certainly bring it on. Sorry. Finally, a new silver bullet comes to the rescue. Monday’s announcement of a cap on CMHC guarantees will prove to be the catalyst. Garth hopes.

Turner is obviously feeling the heat. He had the misfortune of getting into a twitter battle with Calgary’s(maybe even Canada’s) top real estate stats guy, one person who Garth should never tangle with, because he will always come out looking second-best: http://calgaryrealestatereview.com/2013/08/05/garth-turner-attacks-media-reporting-real-estate/

-

You entirely miss the point. The culprit is the media reporting. Your blog post attacking me is weird.

-

@garthturner Not you, your tactics. Always spinning, cherry-picking, massaging stats. Schtick is wearing thin & people seeing through you

-

@MikeFotiou Mike: No smart person builds business by tearing down others. Your blog post will make no difference to me, quite a bit to you.

-

@garthturner People want and deserve the truth. Your credibility outside your echo-chamber blog is waning. Was just some friendly advice.

-

@MikeFotiou You, sir, are no judge of my credibility.

-

@garthturner You’re absolutely right, my apologies. Your track record speaks for itself.

Posted in Fearmongers, Greater Fool, Predictions

Market update July 31, 2013

Record sales in July

Update Aug 1: The Financial Post Magazine contacted me today regarding a story they’re doing about the real estate market across Canada. The reporter was asking why Calgary was so different from other cities. I have my opinions which will eventually be published. What’s your take? (I had to chuckle when they asked about Garth Turner’s bad predictions for Calgary!)

How do you achieve record sales when there’s almost nothing to buy? Inventory is at its lowest point since 2006, so you know that attractive new listings are going fast. As we learned from the craziness of 2006 – 2007, a runaway market is no fun for anyone except a few sellers who are moving to cities where the prices are low or dropping. Many homes are sold by the time a buyer comes to view them. Sellers can realize a quick sale, but if they are moving up or across town, they have all the headaches of looking for a new home with all the difficulties and turmoil of an over-heated market. We require lots more inventory before things will settle down, and there is no sign of that happening.

First-time buyers were up 39% compared to the average of the past 3 years.

The sales-to-new-listings ratio at 80% is the highest it’s been since 2005. Homes under $500,000 are in huge demand, with an absorption rate of 1.1 in July. That is an entrenched seller’s market. Over the last four days of July, 15% of sales were for list price or higher. As Brad stated in his recent comment, Garth Turner looks very foolish for his dire predictions of a nosedive in Calgary’s sales. Be careful who you listen to.

Posted in Calgary SFH, City of Calgary, First-time buyers, Market update, Month-end

Garth Turner @garthturner

Garth Turner @garthturner Mike Fotiou @MikeFotiou

Mike Fotiou @MikeFotiou