Anyone who’s followed the forecasts of the well-educated economists, the pundits like Garth Turner, crazed attention-seeking bubble bloggers, or lowly realtors, the housing market predictions have been a comedy of errors(except for the realtors). Most would excel at being contortionists. Reversing direction so many times has produced dizziness and clouded analysis(see quote on blog header from Calgary Rip-off).

Anyone who’s followed the forecasts of the well-educated economists, the pundits like Garth Turner, crazed attention-seeking bubble bloggers, or lowly realtors, the housing market predictions have been a comedy of errors(except for the realtors). Most would excel at being contortionists. Reversing direction so many times has produced dizziness and clouded analysis(see quote on blog header from Calgary Rip-off).

Porter: Strong sales means we’re drunk

All the bases are now covered. After reading for eons from guys like Garth Turner that the precursor to a crash is lower sales combined with higher prices, we now have Bank of Montreal chief economist Douglas Porter taking the opposite view, saying strong sales are bad news. “Canadians are already drunk on housing, so imbibing more means the inevitable hangover will be all that much worse.”

Madani: Persistent, consistent, and always wrong

“It’s astonishing to me that people are not picking up on this. If you see volumes crash and prices still rising, you shouldn’t be thinking everything is fine, you should see that as a warning sign.” David Madani from Capital Economics has been predicting a 25% drop in prices every year for as long as I can remember, and true to form, he’s back with the same prediction. I won’t be too hard on him, however, since he’s a Bugs Bunny fan. “Homebuilders are having a Wile E. Coyote moment” as when the perpetually ill-starred cartoon character realizes he has overshot the cliff and looks down to see nothing but air under his feet.

Garth Turner: I didn’t say crash

Garth Turner: I didn’t say crash

If Garth were a cartoon character, it would have to be Charlie Brown. He’s been ready to kick the football many times, only to have it pulled away at the last second, time and time again. Every year, some new development is the harbinger of the long-awaited crash: Higher interest rates. 35-year amortizations. Mandatory 5% down payments. 30-year amortizations. Unemployment. 25-year amortizations. Lack of first-time buyers. Now, this year, the silver bullet is the recent capping of CMHC guarantees. For six years he’s been lining up in anticipation of a big score, but rather than kicking the ball through the goal posts, he’s tripped at the line of scrimmage.

His futility has resulted in him saying that he never wanted to kick the ball in the first place. When confronted with the truth, he blames the victims for listening to him: “it was your decision.” Never one to be encumbered by facts, he has managed to keep a loyal following with his fantastic writing ability, sexual connotations, and lewd pictures. If nothing else, he knows that sex sells, understands herd mentality, and that people easily forget. In other words, he’s another Smoking Man but with good grammar and spelling, but not as intelligent. Cult followers have a difficult time thinking for themselves, but they should pay attention to these 10 warning signs. For example, #4 “Unreasonable fear about the outside world, such as impending catastrophe, evil conspiracies.” Yikes.

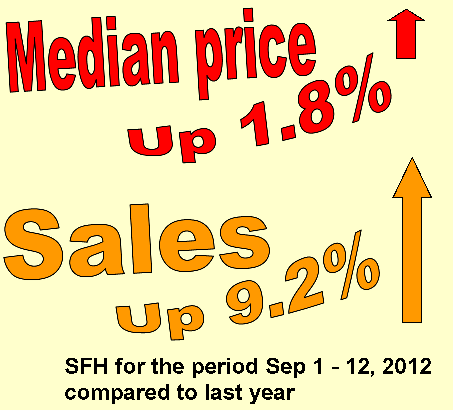

From the Calgary Herald: Canadians appear to be drunk on housing and approaching a hangover