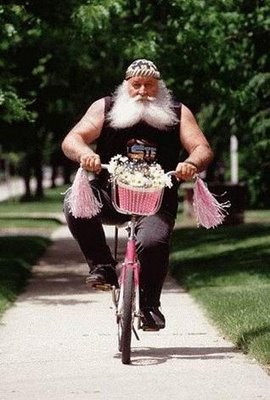

Does Garth really drive a Harley? Can we believe anything he says?

The tone of the comments on Garth Turner’s GreaterFool.ca has taken a pronounced turn. Many readers(and many more whose comments were deleted by Garth) of his blog have finally realized the emperor has no clothes. His long-awaited, much-anticipated housing crash didn’t occur. Garth now denies that he ever predicted a crash, despite writing a book entitled “After the Crash.” The peasants are becoming restless with the never-ending promises of ultra-low house prices. Promises which never become Garth’s fabled houseageddon. Some recent comments which would have been anathema a few years ago…

If your financial advice was half as good as your writing, I’d be buying a nice place in calgary for 360k, not 500k.

I want prices to fall, but its not falling at this point. It’s not as bad as Garth makes it seems.

Spin it any way you like, over 8,000 sales in July for the GTA is a strong month and hardly an indicator of a collapsing housing market.

The truth is that individuals who have been waiting on the sidelines for this event to occur have unfortunately lost an opportunity this time out.

Why is it when anyone posts an opposing view here that they get attacked, called names and chant delete him, delete him? 5 years and waiting for the big collapse maybe a tad frustrating?

If anything, guys like Garth and Peter Schiff that keep calling for crashes just cause others to lose money by waiting for ever.

I’ve been waiting since 2006 for this mythical crash. Maybe in 2053?

Garth there are no signs that real estate is going down at this time in toronto…..after all these mortgage changes it still has held up…..if it is harder to buy now then why after one year has there not been serious cracks in the market…

And the wait continues and the predictions continue to be incorrect.

When will prices be at the same point of when this blog started?

The resiliency of the market has stunned many experts over the past few years – I believe the best advice is to just to get on with your life, and view “Nostradamus type predictions” as “for entertainment purposes only”.

Remember when Garth was selling survival gear and squirrel recipes? Now pretending it never happened: http://shop.xurbia.ca/

Garth’s realtorhate is running at a fever pitch. He now has a knee-jerk reaction to any commenter who disagrees with him. In adition to accusing them of being a realtor, he also calls them liars. Lashing out, making assumptions that are insulting and judgemental, could be a sign that he’s losing his grip.

Turner is a harsh critic of the media, but he forgets that at one time, he was quite happy to take money for advertising which today would be classified as “advertorials.”

- Paying for time:

- Wendy Mesley of CBC: I just wanted to ask you one question about how many financial links there can be to people on your show before it starts to get sticky. Garth Turner: I’ll only answer that by way of saying that, ah, because we’re not the CBC and we don’t get money given to us, that we have to run a business for which revenues are generated and the bulk of the revenues are generated by selling sponsorships and advertising and what we call billboards.

His yearly predictions have been notoriously incorrect, with real estate boards across the country coming through year after year with more accurate forecasts. A pattern of making incorrect predictions.

Okay, so no crash. How about a correction and slow melt? Well, maybe lowering the amortization from 40 to 25 years should do it. Requiring a 5% down payment will most certainly bring it on. Sorry. Finally, a new silver bullet comes to the rescue. Monday’s announcement of a cap on CMHC guarantees will prove to be the catalyst. Garth hopes.

Turner is obviously feeling the heat. He had the misfortune of getting into a twitter battle with Calgary’s(maybe even Canada’s) top real estate stats guy, one person who Garth should never tangle with, because he will always come out looking second-best: http://calgaryrealestatereview.com/2013/08/05/garth-turner-attacks-media-reporting-real-estate/

-

You entirely miss the point. The culprit is the media reporting. Your blog post attacking me is weird.

-

@garthturner Not you, your tactics. Always spinning, cherry-picking, massaging stats. Schtick is wearing thin & people seeing through you

-

@MikeFotiou Mike: No smart person builds business by tearing down others. Your blog post will make no difference to me, quite a bit to you.

-

@garthturner People want and deserve the truth. Your credibility outside your echo-chamber blog is waning. Was just some friendly advice.

-

-

@garthturner You’re absolutely right, my apologies. Your track record speaks for itself.

Garth Turner @garthturner

Garth Turner @garthturner Mike Fotiou @MikeFotiou

Mike Fotiou @MikeFotiou