Usually by this time of year, the median price drops. It’s the old spring up, fall down scenario. Not this year. The median price is higher now than it was in July.

Usually by this time of year, the median price drops. It’s the old spring up, fall down scenario. Not this year. The median price is higher now than it was in July.

Posted in Calgary SFH, Market update

A shortage of inventory and a 9% price increase wouldn’t be considered all that dramatic, except everywhere else sales and prices are dropping. I was mocked way back in the spring when I said that our low inventory would result in price increases. Things have transpired exactly as I predicted.

Posted in Market update

It’s only a short reporting period, but prices and sales have made a considerable uptick for the first week of October. Will Calgary’s housing market eventually succumb to the downturns which are now occurring in Toronto and Vancouver? The cliff appears to be a lot further down the road.

“It may be human nature to gripe, but every now and then we need to open our eyes, take a look around and give thanks for our good fortune in being able to call Alberta home” Read more Giving thanks for Alberta

Posted in Calgary SFH, Market update

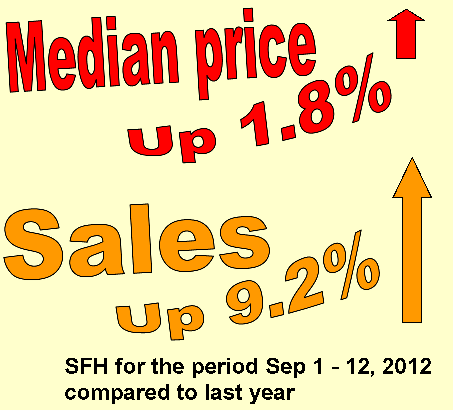

Looking at the September statistics in isolation will not tell you the complete story. It still looks like we’ve got increasing sales along with an inventory shortage, while the median price is up:

The trend is your friend

More importantly, it appears from the table below that we will see decreased sales in October if the trend continues. We’ve had eight consecutive months of sales increases, but I predict that will come to an end next month. What’s the reason for the imminent sales drop? We’ve had sales increases despite extremely low inventory. Is the long-awaited correction finally going to hit Calgary, or is it that buyers have finally run out of homes to purchase?

Posted in Market update, Month-end

I’ve been accused of living in DREAMLAND on Garth Turner’s blog because I’m reporting statistics which don’t conform to the downward trend of sales in the rest of the country. I have no opinion on whether the Calgary market is good or bad, positive or negative. It is what it is. It depends on where you sit. Are you a buyer, a seller, moving up, or moving away? Your personal circumstances will determine how you feel. I’m not going to spin things in order to please a constituency with an agenda. You’ll be able to make a wiser decison about your activities in the market if you have the facts, and here they are:

As I’ve oft repeated in the past, if inventory stays low, it will continue to put upward pressure on prices. Sales numbers are pretty consistent with the past 3 years, but would be much higher if there were more listings coming onto the market.

As I’ve oft repeated in the past, if inventory stays low, it will continue to put upward pressure on prices. Sales numbers are pretty consistent with the past 3 years, but would be much higher if there were more listings coming onto the market.

Posted in Calgary SFH, Market update

Only three days ago, we read in the Calgary Herald, Calgary housing prices and sales on the decline in September. This headline made front page news on the doomer blogs.

Only three days ago, we read in the Calgary Herald, Calgary housing prices and sales on the decline in September. This headline made front page news on the doomer blogs.

The bubble bloggers took this as a sign that Calgary was joining Toronto and Vancouver on the road to real estate Armageddon. What a difference 3 days can make. I can guarantee that you won’t be seeing any links posted to my headline on the fearmonger’s blogs. They’re not interested in enlightenment or accurate statistics. They prefer to reinforce their agenda with selective data which reinforces their group-think.

What should be of greatest concern is that the housing market in Calgary has a shortage of listings. Inventory is down 23% compared to last year. Can you imagine how much higher the sales increase would be if there was a better selection of homes for buyers?

Posted in Calgary Herald, Calgary SFH, Fearmongers, Market update

Sunshine, lollipops, and puppy dogs can also be added to the basket of good things which we have in Calgary. Unlike the craziness which has befallen the real estate market in Vancouver, we have stability in the world’s fifth most liveable city. If you believe the Toronto Board of Trade, Calgary is the best city on the planet. Let’s hope that Garth Turner’s recent visit here did not infect us with the Toronto disease of negativity and defeatism. It appears that no amount of loathing from the likes of jealous Ontarians will have any effect on our terrific city and its potential. Calgary remains an oasis of innovation and entrepreneurial spirit, with a balanced and healthy real estate market.

Sunshine, lollipops, and puppy dogs can also be added to the basket of good things which we have in Calgary. Unlike the craziness which has befallen the real estate market in Vancouver, we have stability in the world’s fifth most liveable city. If you believe the Toronto Board of Trade, Calgary is the best city on the planet. Let’s hope that Garth Turner’s recent visit here did not infect us with the Toronto disease of negativity and defeatism. It appears that no amount of loathing from the likes of jealous Ontarians will have any effect on our terrific city and its potential. Calgary remains an oasis of innovation and entrepreneurial spirit, with a balanced and healthy real estate market.

Just this morning I heard our dynamic and enlightened mayor, Naheed Nenshi, on the Eyeopener describing Calgary as the city of the future. I like our mayor, but I disagree. We are the city of the here and now, and the envy of the world. After seeing recent political developments, let’s get ready to welcome an influx of progressive, free-thinking people from Quebec to the city of opportunity.

RBC’s latest Housing Trends and Affordability Report said the local market has enjoyed the best of all worlds recently: stronger home resales and home building, moderately rising prices, and attractive and improving affordability. Calgary housing market among Canada’s most affordable

RBC’s latest Housing Trends and Affordability Report said the local market has enjoyed the best of all worlds recently: stronger home resales and home building, moderately rising prices, and attractive and improving affordability. Calgary housing market among Canada’s most affordable

We’re not without some challenges, however, but our problems are small by comparison. Not enough inventory is the major concern. Students are having a hard time finding accommodation this semester. I guess it all depends which side of the fence you’re on. Landlords can pick and choose who they’ll rent to, and get a fair return on their investment. Tenants, on the other hand, will be paying more and will be getting screened more carefully.

Down to the nitty-gritty data, very little has changed since I last blogged two months ago. I fully expected we’d be seeing the usual autumn price drops by now, but the median price is still at spring-like levels. Inventory is still low, down 22% compared to last year. It’s difficult to have sales increases when there’s so little choice for buyers, but somehow, sales are still up over last year, and also up compared to the 3-year average.

First-time buyers

Two months ago, we were inundated with dire predictions of a market collapse when the end of 30-year amortizations was introduced. I expected first-time buyers would be hit hardest by the new rules, but the impact has been minimal. The table below is typical of the homes which first-time buyers will purchase, and is identical to last year, except for a slightly higher price:

| Date | # Sales | Price per sq ft |

| 2012 | 188 | $250 |

| 2011 | 188 | $239 |

| Criteria: 2-storey homes in the suburbs under 1700 sq ft for the 30-day period Aug 8 – Sep 6, 2012 | ||

The biggest obstacle for first-timers is the lack of inventory. It’s hard to buy a house when there’s nothing to choose from. For the market to remain viable, we need buyers at the entry level so that move-up buyers can sell. This lack of listings really shows up in the “under $500,000” price range, where there is only a 66-day supply of homes for sale.

What happens when there’s a lack of inventory?

When there’s a lack of inventory, an attractive and accurately-priced home will sell quickly. The above house was listed in the morning and had a conditional sale by sundown.

I hope you’ve enjoyed the great weather this summer. Between real estate transactions, I finally climbed Canada’s highest maintained hiking trail which is right on our back door in beautiful Kananaskis Country. Centennial Ridge – Mt Allan hike.

Check back often, as I’ll be updating the blog regularly, at least until ski season starts.

Posted in Calgary SFH, First-time buyers, Market update, Mortgages, Renting

Although the mortgage rules changed on July 9, this past week(July 9- 15) would have been the period where a lot of the last-gasp deals were finalized and showed up on the books. The 30-day sales-to-new-listings ratio today is at 77%, the highest it’s been in July since 2005, but I wouldn’t read much into it. I attribute it to the fact that a preoccupation with Stampede prevented people from listing their homes, while at the same time, a flurry of sales which were conceived 10-15 days ago were being finalized. I’d expect to see a lot of new listings in the coming weeks, with not so brisk a pace of sales. Compared to last year only, sales were up 37% this past week, while new listings were down 10%.

I’ve long maintained that average prices are a poor indicator of the housing market. Here’s a story that goes a little further Average house prices don’t tell the whole story.

Posted in Market update, Statistics

If previous years’ patterns hold true, July should be the month where sales and prices start to drop. It’s already evident from the statistics when compared to the last few months, as single family home sales for the first week of July were the slowest start to a month since March, but compared to the past three years, the market is still vibrant.

Posted in Market update